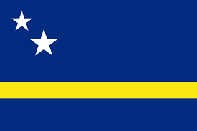

Why to invest in Curazao

| Curazao at a glance | |

|---|---|

| LOCATION | Caribbean Sea |

| CAPITAL | City of Willemstad |

| OFFICIAL LANGUAGE | Dutch and Papiamento are the official languages; English is also widely spoken. |

| CURRENCY | Antillean guilder (pegged directly to the US$) |

| POPULATION | 155,872 inhabitants 2014 |

| AREA | 444 km2 |

| POLITICAL SYSTEM | Autonomous country within the Kingdom of the Netherlands / Parliamentary democracy |

| PIB | 3,255 million US$ 2013 / 21,000 US$ per capita 2014 |

| Source of economic figures: World Bank | |

The Island of Curazao is considered one of the most efficient areas of the Caribbean to establish commercial and financial relations between Latin America and Europe.

Its traditional relation with the European continent, due to having been part of the Kingdom of The Netherlands for years, complemented with a multicultural entrepreneurial environment and its developed infrastructures, make this island a highly attractive jurisdiction for foreign investment.

Curazao has juridical security and a reputation at the level of protection of goods and assets that is much more consistent, that is exemplified by the fact of being one of the few countries in the area that complies with the international rules and requisites established by the Operation for Economic Co-operation and Development (OECD) and by the FATF.

Moreover, its constant growth and financial development in recent years, aided by creation of an attractive tax and legislative framework, that have led to Curazao now being considered one of the most used destinations for investment diversification and internationalisation.

Taxation and Type of Companies

Both for resident natural persons as well as legal persons, the tax system is based on the criteria of world revenue. The exception are non residents, who are only taxed on the revenue obtained directly in Curazao.

There is no wealth tax.

Taxation of Individuals

Personal income tax for individuals is defined by bands and normally ranges from 0% to 48.25%, according to the volume of revenue received during the financial year.

There are special particular regimes such as, for example: Fixed 10% for all the revenue from a foreign source (regime for pensioners) or fixed 19.50% for revenue received from Private Interest Foundations or Trusts.

Taxation of Corporate Entities

Company tax is 25%.

General Value Added Tax (VAT) is 6% and, for other products, such as, for example, first need assets or services of interest to the region, there are reduced VAT rates.

Other Taxes

At the level of notable taxes, we could distinguish the following:

Property Conveyance Tax (real estate): 4%

Inheritance tax: 6% maximum

Donation tax: 24% as a general rate and 25% for Private Interest Foundations and Trusts.

Characteristics of Curazao NV Companies

There are now various types of companies in Curazao, the most common being the Curaçao Naamloze Vennootschal (NV), equivalent to the European SA, or American corporations.

NV companies are highly flexible companies, both in terms of shareholders as well as directors, as both offices may be held by natural or legal persons, both resident or foreign. Even so, it is recommendable for at least one local resident to be appointed to the office of director.

With regard to the stock capital, there is no obligatory minimum required and it must be nominative (although in the case of the NV, these may be transformed to bearer shares once the company is formed. However, the possibility of adapting and regulating the Articles of Association, voting rights, distribution of the shareholding value, as well as conveyance of shares in the company.

With regard to their accounting obligations, NV companies must prepare annual financial statements, that must be prepared within the 8 months following the financial year end, according to the criteria of the International Financial Reporting Standards (IFRS). Large companies also require an external annual audit. In order to be considered a large company, these must fulfil a series of requisites based on the value of their assets, the amount of profit and the number of workers.

Benefits of the Curazao Corporate System

Holding Regime (“Participation Exemption”)

In its legislation, Curazao has developed a holding regime that eliminates revenue obtained from subsidiary dividends or capital gains generated from their sale from the taxable base. The conditions to obtain exemption are:

The Curazao company must be the owner of at least 5% of the capital of the subsidiary company.

The subsidiary company must be subject to a minimum tax of 10%.

The subsidiaries must be considered active companies, that is, a maximum of 50% of their revenue must come from dividend activities, interest or liberalities.

Moreover, by internal regulation, Curazao does not perform withholdings at source at the moment of paying dividends to shareholders.

E-Zone Companies

E-zone companies are companies with their registered office in particular zones that are taxed at 2% on revenue obtained from trading and service activities in which foreign companies intervene (valid until 31st December 2025).

E-zone companies cannot provide financial services, pay liberalities, perform insurance activities, nor reinsurance, nor may they provide corporate management and trust services.

Private Interest Foundations

Private Interest Foundations (PIF) are entities with their own juridical status that do not pay taxes and that allow effective asset protection, both in their management and maintenance, as well as their conveyance. Its main characteristic is that, even though it has its own juridical status, it does not have shareholders, but rather beneficiaries (not publicly registered), who are defined in private internal regulations or a letter of intentions.

These allow profit distribution without these payments having a charitable or social intention.

In tax terms, the PIF are fully tax exempt, both at the level of the benefit generated by the existing assets, as well as in the revenue contributed.

Conventions

Curazao is on the white list of OECD countries and signed the FATCA convention with the United States in 2014.

Network of Conventions to Avoid Double Taxation

UAs of December 2015, Curazao had signed conventions to avoid double taxation with Norway and The Netherlands (it includes the islands of Aruba and Saint Marteen). For more details, consult our summary of the etworks of conventions to avoid double taxation ...

Network of Information Exchange Conventions

Curazao has also signed a series of Information Exchange Agreements (IEA).

| IEAs SIGNED BY CURAZAO | |

|---|---|

| COUNTRY | YEAR OF ENACTMENT |

| Antigua and Barbuda | December 5, 2013 |

| Bermuda | 8th April 2015 |

| Canada | 1st January 2011 |

| Denmark | 1st July 2011 |

| Spain | 27th January 2010 |

| United States | 22nd March 2007 |

| Finland | 1st June 2011 |

| France | 1st August 2012 |

| Greenland | 1st May 2012 |

| Iceland | 1st January 2012 |

| Faroe Islands | 1st July 2011 |

| Mexico | 4th February 2011 |

| New Zealand | 2nd October 2008 |

| United Kingdom | 1st May 2013 |

| Santa Lucia | 1st October 2013 |

| Saint Kitts and Nevis | 6th November 2014 |

| Saint Vincent and the Grenadines | 31st July 2013 |

| Sweden | 20th April 2011 |